Australia and New Zealand have different rules for Layby sales.

In New Zealand, regardless if your business is Cash or Accruals Accounting, the Layby becomes a sale on the Final Payment Made. All layby details are stored in Idealpos.

With the GST Accounting Method set to Accrual, Laybys become a Sale when the Final Payment is made.

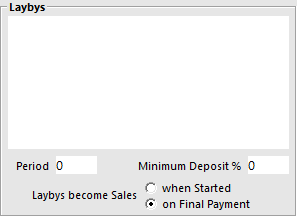

Go to Setup > Global Options > Customers > Layby becomes Sales on Final Payment.

In Setup > Global Options > Miscellaneous, set the GST Accounting Method to Accrual.

A Lay-by sale of $50 inclusive of GST with a $10 Deposit paid on Cash.

A Final Payment of $40 has been applied to the layby.

A Lay-By sale of $50 Inclusive of GST with a deposit of $10.00 Cash. An Adjustment of $1.00 was applied to this Lay-By with an owing balance of $39.00.

Debit Adjustments cannot be performed when using the Accounting Module Interface.

Cancel a $50.00 Lay-By with a deposit of $10.00 Inclusive of GST.

The customer’s initial $10 deposit will be fully refunded with no cancellation fees.

The first Journal shows the initial sale of $50 and $10 deposit:

Then the Layby Cancellation refunding monies paid:

Cancel a $50.00 Lay-By with a deposit of $10.00 and a service fee of $5.00 and refund of $5.00.

The first Journal shows the initial sale of $50 and $10 deposit:

Then the Layby Cancellation refunding monies paid less the $5.00 layby cancellation fee:

With the GST Accounting Method set to Cash, Laybys become a Sale when the Layby is first Started.

Go to Setup > Global Options > Customers > Layby becomes Sales when Started.

In Setup > Global Options > Miscellaneous, set the GST Accounting Method to Cash.

A Lay-by sale of $50 inclusive of GST with a $10 Deposit paid on Cash.

A Final Payment of $40 has been applied to the layby.

A Lay-By sale of $50 Inclusive of GST with a deposit of $10.00 Cash. An Adjustment of $1.00 was applied to this Lay-By with an owing balance of $39.00.

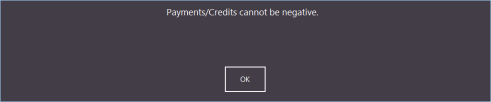

Lay-By Payments and Credits cannot be negative.

Cancel a $50.00 Lay-By with a deposit of $10.00 Inclusive of GST.

The customer’s initial $10 deposit will be fully refunded with no cancellation fees.

The first Journal shows the initial sale of $50 and $10 deposit:

Then the Layby Cancellation refunding monies paid:

Cancel a $50.00 Lay-By with a deposit of $10.00 and a service fee of $5.00 and refund of $5.00.

The first Journal shows the initial sale of $50 and $10 deposit:

Then the Layby Cancellation refunding monies paid less the $5.00 layby cancellation fee: